Decentralized Finance, often referred to as DeFi, has been a revolutionary force in the world of finance. Its promise of democratizing financial services and reducing the need for traditional intermediaries has garnered significant attention. However, the first generation of DeFi faced limitations that hindered its potential. Enter DeFi 2.0, the future of decentralized finance, which seeks to overcome these limitations and take the world of blockchain-based financial services to the next level. In this article, we will delve into the limitations of DeFi, explore the concept, understand how it works, its key features, potential investment opportunities, use cases, and the challenges it faces.

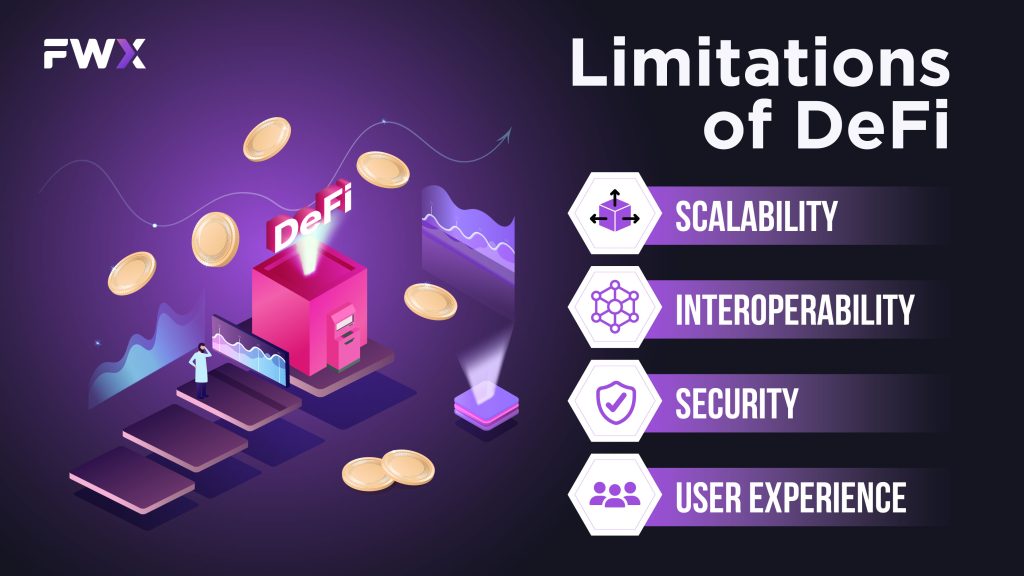

Limitations of DeFi

Before we dive into the world of DeFi 2.0, it’s essential to understand the limitations of its predecessor, DeFi 1.0. These limitations include:

- Scalability: DeFi 1.0 struggled with scalability issues, leading to slow transaction processing times and high fees. This hindered its potential for mass adoption. As the number of users and transactions increased, the blockchain networks supporting DeFi 1.0 became congested, causing delays and increased costs for users.

- Interoperability: DeFi projects often operated in isolation, making it challenging for users to access a wide range of financial services seamlessly. Cross-communication between different DeFi platforms and blockchains was limited, hindering the creation of a truly interconnected and efficient financial ecosystem.

- Security: DeFi 1.0 projects were susceptible to hacks and vulnerabilities, which undermined trust in the ecosystem. Several high-profile exploits and vulnerabilities in smart contracts led to substantial financial losses for users. These security issues raised questions about the long-term sustainability of DeFi.

- User Experience: Many DeFi platforms were not user-friendly, deterring mainstream adoption. Complex user interfaces, confusing terminology, and the requirement of technical expertise created significant barriers to entry for non-technical users.

What is DeFi 2.0?

DeFi 2.0 represents the evolution of decentralized finance, addressing the limitations of its predecessor while pushing the boundaries of what’s possible. It builds upon the principles of DeFi but introduces several key innovations to enhance its functionality, scalability, security, and user experience.

How does DeFi 2.0 work?

DeFi 2.0 leverages advanced technologies such as Layer 2 scaling solutions, cross-chain interoperability, and improved consensus mechanisms to create a more efficient and user-friendly ecosystem. Here’s how it works:

- Layer 2 Scaling: DeFi 2.0 employs Layer 2 scaling solutions like Optimistic Rollups and zk-Rollups to improve transaction throughput and reduce fees. These solutions allow a significant number of transactions to be processed off-chain while maintaining the security of the main blockchain.

- Cross-Chain Integration: It enables seamless interactions between different blockchains, allowing assets and data to flow across multiple networks. This interconnectedness breaks down the barriers between different DeFi ecosystems, creating a global financial network.

- Enhanced Security: DeFi 2.0 places a strong emphasis on security by using advanced smart contract auditing and formal verification techniques. These measures help identify vulnerabilities and flaws in smart contracts before they are deployed, reducing the risk of exploits and hacks.

- User-Centric Design: User experience is a priority in it, with user-friendly interfaces and simplified onboarding processes. This makes it more accessible to a broader range of users, from those with no prior experience in DeFi to seasoned crypto enthusiasts.

DeFi 2.0 key features

DeFi 2.0 introduces several key features that set it apart from its predecessor:

- Scalability: With Layer 2 solutions, it offers faster transaction processing and lower fees, making it more accessible to a wider audience. These solutions relieve congestion on the main blockchain and enhance the overall speed and efficiency of transactions.

- Interoperability: DeFi 2.0 projects can communicate and share data across different blockchains, expanding the range of available financial services. This interoperability enables the seamless movement of assets and information across various networks.

- Enhanced Security: Advanced security measures reduce the risk of hacks and vulnerabilities, fostering trust in the ecosystem. Formal verification and rigorous auditing processes help ensure that smart contracts are free from critical flaws.

- User-Friendly Interfaces: DeFi 2.0 platforms prioritize user experience, making it easier for both newcomers and experienced users to navigate the ecosystem. Intuitive interfaces, clear instructions, and responsive customer support create a more welcoming environment for users.

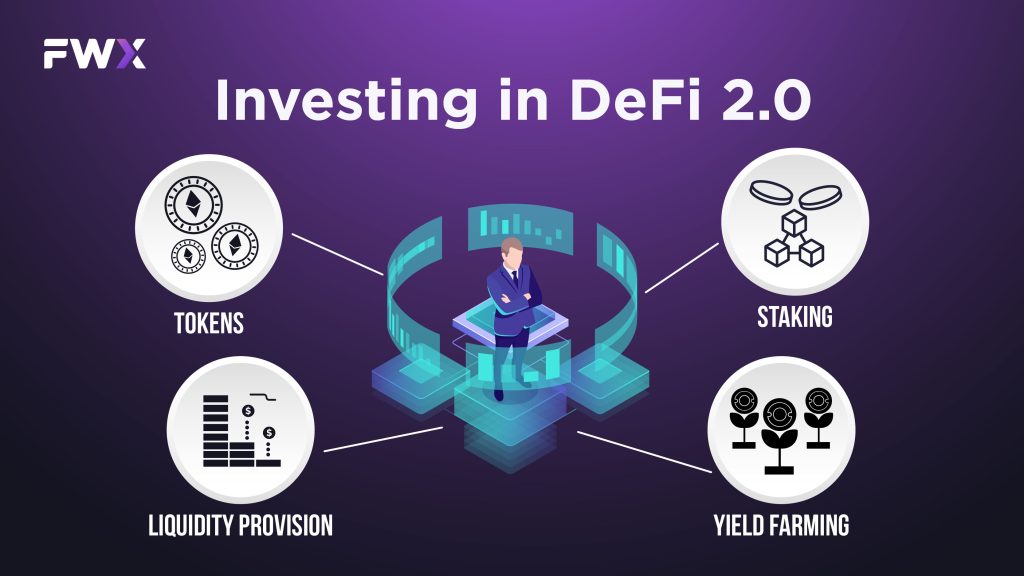

Investing in DeFi 2.0

For those looking to invest in DeFi 2.0, there are several options to consider:

- Tokens: Invest in tokens associated with promising DeFi 2.0 projects. Conduct thorough research and consider factors like the team, technology, and community support. Diversify your investments across different projects to spread risk.

- Staking: Some DeFi 2.0 projects offer staking opportunities where users can earn rewards by locking up their tokens. Staking can provide passive income through token rewards and is a way to actively participate in network security.

- Liquidity Provision: Providing liquidity to decentralized exchanges on DeFi 2.0 platforms can generate passive income through trading fees. This is known as liquidity mining, where users contribute assets to liquidity pools and receive a portion of the transaction fees in return.

- Yield Farming: Yield farming involves providing assets to DeFi protocols in exchange for interest or rewards. It’s a more complex form of liquidity provision that often requires users to move their assets between different DeFi platforms to maximize their returns.

It’s crucial to conduct thorough research before making any investments, as the DeFi space can be highly volatile, and not all projects may have a solid long-term outlook.

DeFi 2.0 use cases

The potential use cases for DeFi 2.0 are extensive, including but not limited to:

- Cross-Border Payments: DeFi 2.0 can facilitate faster and cheaper cross-border payments and remittances. By utilizing cross-chain interoperability, users can send and receive funds across borders with reduced fees and faster settlement times.

- Asset Tokenization: It enables the tokenization of real-world assets, making them more accessible for investors. Real estate, art, and other valuable assets can be represented as digital tokens, allowing fractional ownership and increased liquidity.

- Decentralized Identity: Enhanced security measures in DeFi 2.0 can be applied to create secure decentralized identity systems. Users can have control over their personal data and digital identities, reducing the risk of data breaches and identity theft.

- Supply Chain Finance: Improved scalability and interoperability can benefit supply chain finance applications. It can be used to streamline supply chain processes, reduce fraud, and improve transparency in global supply chains.

- DeFi Derivatives: DeFi 2.0 platforms can facilitate the creation and trading of decentralized derivatives, enabling users to gain exposure to various financial instruments without relying on traditional financial institutions.

- Decentralized Autonomous Organizations (DAOs): It can power DAOs with more robust governance mechanisms, allowing communities to make decisions collectively and manage decentralized projects.

DeFi 2.0 challenges

While DeFi 2.0 holds great promise, it also faces several challenges:

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving and could pose challenges in the future. Governments and regulatory bodies are increasingly focusing on DeFi, which may lead to compliance requirements and restrictions.

- Adoption: Mass adoption remains a hurdle, and user education is essential to bridge this gap. Many potential users are unfamiliar with blockchain technology and DeFi, and educational efforts are needed to onboard new participants.

- Security Concerns: Although security is improved in DeFi 2.0, the threat of exploits and vulnerabilities is ever-present. As the technology evolves, so do the tactics of malicious actors. Continuous security audits and research are required to maintain a secure environment.

- Competition: The DeFi space is highly competitive, and new projects must differentiate themselves to succeed. Established projects in DeFi 1.0 may also transition to DeFi 2.0, intensifying competition within the ecosystem.

Conclusion

DeFi 2.0 represents the next phase in the evolution of decentralized finance, addressing the limitations of its predecessor while introducing advanced features and enhanced security. As the DeFi 2.0 ecosystem continues to develop, investors, developers, and users should closely monitor its progress and contribute to its growth. The potential for a more accessible and efficient financial system is within reach, and DeFi 2.0 is at the forefront of this transformative journey. While challenges persist, the innovative spirit of the DeFi community is likely to drive continued advancements in the field, ultimately reshaping the future of finance on a global scale. As we move forward, It serves as a testament to the ongoing evolution of blockchain technology and its ability to revolutionize traditional financial systems.