Knowing about crypto staking and the cryptocurrencies that support it can help you earn passive income while supporting the network’s operations and enhancing the security and decentralized finance of the cryptocurrency ecosystem. It is also important to understand the risks and rewards associated with staking before participating.

What is staking in crypto?

Crypto staking is a process in which users hold their cryptocurrency tokens or coins in a digital wallet for a predetermined period of time, as a means of participating in the network and receiving rewards in return.

Staking is a way of validating transactions on a blockchain network by locking up a certain amount of tokens as collateral. By doing so, stakers contribute to the security of the network, and in return, they receive incentives, such as additional tokens or coins.

The staking process varies depending on the cryptocurrency and its protocol. However, typically, staking involves locking up a certain amount of tokens, choosing a validator or delegator, and participating in the network consensus process. Validators are responsible for verifying transactions, while delegators support the validators by providing them with the necessary tokens.

It allows users to earn rewards for their participation in network consensus while also contributing to the network’s security and decentralization. However, staking involves certain risks, including the possibility of losing staked tokens due to network errors or malicious attacks. Therefore, it is essential to consider the risks and rewards associated with staking before participating.

What cryptocurrencies allow staking?

Many cryptocurrencies use staking as a consensus mechanism. Here are some popular cryptocurrencies that allow staking and their consensus mechanism:

Proof-of-Stake (PoS) is a consensus algorithm in which validators are selected to mine and validate blocks based on their staked cryptocurrency.

- Cardano (ADA)

- Polkadot (DOT)

- Ethereum 2.0 (ETH)

- Cosmos (ATOM)

- Algorand (ALGO)

- Tezos (XTZ)

- Avalanche (AVAX)

- Solana (SOL)

- Binance Coin (BNB)

Proof-of-Work (PoW) is a consensus algorithm in which miners compete to solve complex mathematical problems to mine and validate blocks in exchange for rewards.

- Bitcoin (BTC)

- Litecoin (LTC)

- Dash (DASH)

- Zcoin (XZC)

Additionally, some cryptocurrencies may use a hybrid consensus mechanism that combines both PoW and PoS, such as Decred (DCR). Overall, staking has become a popular alternative to PoW mining for its energy efficiency and ability to incentivize network participation.

How does staking work?

Staking involves locking up a certain amount of cryptocurrency as collateral to support a blockchain network’s operations and validate transactions. In exchange, network participants earn rewards in the form of additional cryptocurrency.

For example, let’s consider Cardano (ADA), a popular cryptocurrency that uses a PoS consensus mechanism. To stake ADA, users can delegate their stake to a pool operator, who will run a validator node on behalf of the delegators. The more ADA staked, the higher the chances of the validator node being selected to validate transactions and create new blocks. When a validator successfully validates a block, they earn rewards in ADA, which are distributed among all the delegators based on their contribution.

Another example is Ethereum 2.0 (ETH), which also uses a PoS consensus mechanism. To stake ETH, users need to deposit at least 32 ETH into a smart contract, which is then locked up for a certain period. In exchange, they receive staking rewards in ETH for validating blocks.

Staking provides a way for users to earn rewards while supporting the network’s security and operations, and it has become an increasingly popular alternative to PoW mining.

Is staking good for crypto?

Staking has several benefits for the cryptocurrency ecosystem and can be considered good for crypto in several ways:

- Energy efficiency: Staking is a more energy-efficient consensus mechanism than PoW mining, which requires significant computing power and energy consumption.

- Decentralization: Staking incentivizes network participation and decentralization by allowing a wider range of participants to support the network’s operations.

- Security: Staking enhances the network’s security by reducing the likelihood of a 51% attack, where an attacker controls the majority of the network’s computing power.

- Price stability: Staking incentivizes users to hold onto their cryptocurrency, reducing selling pressure and increasing the token’s value.

- Rewards: Staking provides a way for users to earn rewards by supporting the network, creating a more engaged and incentivized community.

Staking provides a sustainable and secure way to maintain the blockchain and incentivize network participation, making it beneficial for the cryptocurrency ecosystem

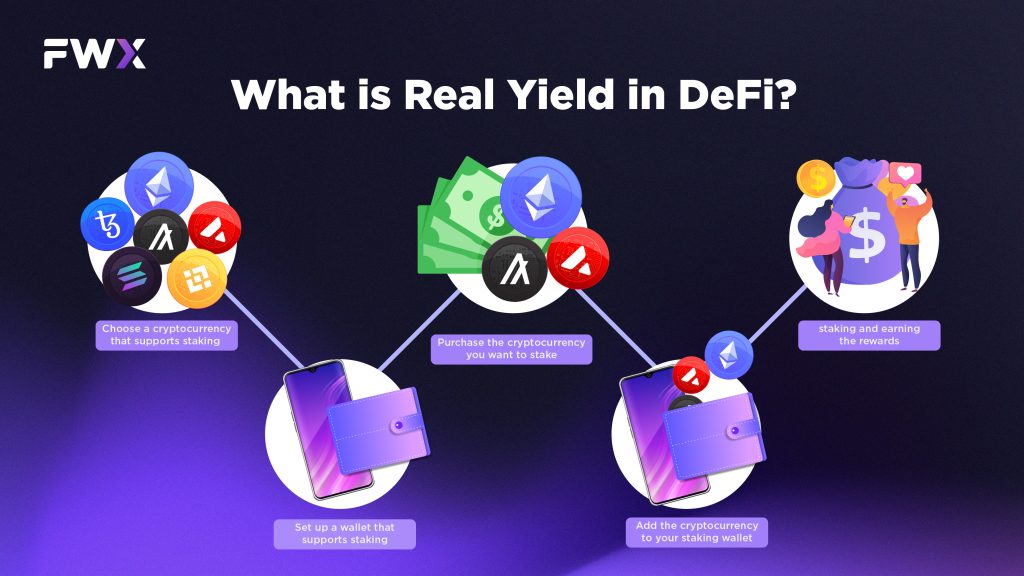

How to Stake Crypto in 5 Steps

Staking crypto can be a great way to earn passive income while supporting the network. Here are five steps to stake crypto:

- Choose a cryptocurrency that supports staking – Not all cryptocurrencies support staking, so it’s important to choose one that does. Some popular options include Ethereum, Cardano, and Polkadot.

- Set up a wallet that supports staking – Many wallets support staking, but it’s important to choose one that is compatible with the cryptocurrency you want to stake. Examples of wallets that support staking include Ledger, Trezor, and MyEtherWallet.

- Purchase the cryptocurrency you want to stake – Once you’ve chosen a cryptocurrency and wallet, you’ll need to purchase the cryptocurrency.

- Send the cryptocurrency to your staking wallet – Transfer the cryptocurrency to your staking wallet and follow the instructions for staking.

- Start staking and earning rewards – Once you’ve staked your cryptocurrency, you can sit back and earn rewards. The exact amount of rewards will vary depending on the cryptocurrency and the amount of cryptocurrency you’ve staked.

Can you lose crypto by staking?

Yes, it is possible to lose crypto by staking. Staking involves locking up your cryptocurrency for a set period of time as collateral to support the operations of a blockchain network. In return, you earn rewards in the form of more cryptocurrency. However, there are some risks associated with staking that could result in the loss of your staked crypto, such as:

- Slashing – If you fail to follow the rules or perform malicious activities, such as double-spending, you could lose some or all of your staked crypto as a penalty.

- Network failure – If the blockchain network you are staking on experiences a major technical issue or is attacked, you could lose some or all of your staked crypto.

- Market volatility – The value of your staked crypto may fluctuate during the staking period, meaning you may receive less than what you initially staked.

To mitigate the risks of staking, it is important to do your research and choose a reliable and trustworthy blockchain network to stake on. Additionally, you can consider diversifying your staked crypto across multiple networks to minimize the impact of any one network failure.

Conclusion

Crypto staking is the process of holding cryptocurrency tokens or coins in a digital wallet for a predetermined period of time to participate in the network and receive rewards in return. Staking validates transactions on a blockchain network by locking up tokens as collateral. The staking process varies depending on the cryptocurrency and its protocol. Several popular cryptocurrencies support staking, including Cardano, Polkadot, Ethereum 2.0, Cosmos, and more.

Staking is a passive income-generating activity that contributes to the network’s security and decentralization. Staking has several benefits, including energy efficiency, decentralization, security, price stability, and rewards. However, there are risks involved, including the possibility of losing staked tokens due to network errors or malicious attacks. Staking crypto involves choosing a cryptocurrency that supports staking, setting up a staking wallet, purchasing the cryptocurrency, transferring it to the staking wallet, and staking the cryptocurrency to earn rewards.