Holding crypto means holding potential, but what if you need immediate access to cash without selling your precious coins? Enter crypto loans, a game-changer in the digital asset landscape. Let’s unlock the mysteries of these financial instruments and see how they can work for you.

What are crypto loans?

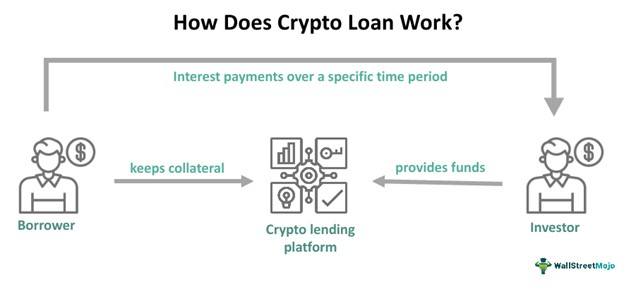

Crypto loans are financial arrangements that enable individuals to borrow or lend digital assets. In essence, they allow cryptocurrency holders to leverage their digital assets as collateral to secure loans or earn interest through lending. This decentralized financial system provides an alternative to traditional banking and lending institutions, offering a more inclusive and accessible approach to borrowing and lending.

What is borrower?

In the context of crypto loans, a borrower refers to an individual or entity seeking to obtain a loan by leveraging their cryptocurrency holdings as collateral. Borrowers may include investors looking to access liquidity without selling their digital assets, traders seeking additional capital for leveraged trading, or individuals in need of fiat currency for personal or business purposes.

How do crypto loans work?

Crypto loans can operate in two ways: borrowing or lending, each with its own mechanics. Here’s a breakdown:

Borrowing Crypto:

- Collateral: You deposit your cryptocurrency holdings (Bitcoin, Ethereum, etc.) as collateral with a lender.

- Loan Amount: You choose the loan amount you need, typically up to a certain percentage (Loan-to-Value ratio) of your collateral’s value.

- Interest & Fees: You agree to an interest rate and any fees associated with the loan. Interest can be fixed or variable depending on the platform.

- Repayment: You repay the loan in installments with added interest over a set timeframe.

- Collateral Return: Upon full repayment, you get your originally deposited crypto back.

- Deposit: You deposit your cryptocurrency into a lending platform.

- Interest Earned: The platform lends your crypto to borrowers, and you earn interest on your holdings, usually paid daily, weekly, or monthly.

- Interest Rate: The interest rate depends on the platform, cryptocurrency, and loan demand.

- Liquidity: You retain the ability to withdraw your crypto at any time, although some platforms may have lock-in periods for higher interest rates.

Source: https://www.wallstreetmojo.com/crypto-loan/

Types of crypto loans

Collateralized loans

Overview:

These are the most common type of crypto loan, requiring you to deposit cryptocurrency as collateral to secure the loan. This reduces risk for the lender and allows you to borrow up to a certain percentage (Loan-to-Value ratio) of your collateral’s value.

Use Case:

Leverage trading: Traders can use collateralized loans to amplify their position in a cryptocurrency without selling their existing holdings.

Emergency funds: Investors can access cash quickly by using crypto as collateral, avoiding the need to sell during a market downturn.

Flash loans

Overview:

These are short-term, uncollateralized loans that are repaid within the same Ethereum block. They utilize smart contracts to execute complex financial transactions without requiring any upfront security.

Use Case:

Arbitrage opportunities: Traders can exploit price discrepancies between different exchanges by borrowing and repaying within a single block.

Collateralization for other DeFi protocols: Users can take flash loans to temporarily increase their collateral and access other DeFi opportunities.

Important Note: Flash loans are complex and can be risky if not used properly. Only experienced users should consider them.

Uncollateralized loans

Overview:

These are rare in the crypto space due to the inherent risks involved. They rely on the borrower’s creditworthiness and reputation rather than collateral.

Use Case:

Institutional borrowers: Large institutions with strong credit ratings may be able to secure uncollateralized loans from specialized lenders.

Important Note: Uncollateralized crypto loans are generally not recommended for individual investors due to the high risk of default.

Line of credit

Overview:

Similar to traditional lines of credit, crypto lines of credit allow you to borrow and repay funds as needed, up to a pre-approved limit. Interest is typically charged only on the used portion of the line.

Use Case:

Managing cash flow: Investors can use a crypto line of credit to cover unexpected expenses or bridge funding gaps without selling their holdings.

Custodial CeFi crypto loans

Overview:

These loans are offered by centralized platforms like exchanges or lending companies. They hold your collateral in their custody and manage the loan process.

Use Case:

Ease of use: Custodial loans are convenient for beginners as they simplify the process and offer user-friendly interfaces.

Important Note: You give up control of your collateral to the platform when using custodial loans. Choose reputable platforms with strong security measures.

DeFi crypto loans

Overview:

These loans utilize decentralized protocols and smart contracts to facilitate borrowing and lending without the need for a central authority.

Use Case:

Greater control: DeFi loans offer greater control over your collateral and potentially higher interest rates compared to CeFi options.

Important Note: DeFi loans can be complex and require technical knowledge. They also carry higher risks due to potential smart contract vulnerabilities and market volatility.

CeFi crypto loans vs DeFi crypto loans

Choosing between CeFi (Centralized Finance) and DeFi (Decentralized Finance) crypto loans depends on your priorities and risk tolerance. Here’s a comparison to help you decide:

Centralized Finance (CeFi) Crypto Loans:

Pros:

- Higher Liquidity: Wider range of loan options and potentially faster access to funds.

- Regulatory Compliance: Platforms are subject to financial regulations, offering some security.

- Customer Support: Dedicated customer support teams are available for assistance.

Cons:

- Centralized Control: You relinquish control of your collateral to the platform.

- Counterparty Risk: Platforms are vulnerable to hacks or mismanagement.

- Fees: May have higher interest rates and additional fees compared to DeFi.

- Limited Transparency: Loan terms and algorithms might not be fully transparent.

- Potential Censorship: Platforms can potentially restrict access to certain loans or users.

Decentralized Finance (DeFi) Crypto Loans:

Pros:

- Decentralization: No central authority controls your funds or the loan process.

- Transparency: Smart contracts provide clear and immutable loan terms.

- Potential Higher Returns: DeFi platforms often offer higher interest rates for lenders.

- Greater Control: You maintain complete control over your collateral and loan terms.

- Innovation: DeFi protocols offer a wider range of experimental loan options.

Cons:

- Complexity: Requires technical knowledge and understanding of smart contracts.

- Steeper Learning Curve: Not beginner-friendly, navigating DeFi can be challenging.

- Security Risks: Smart contracts are vulnerable to exploits and hacks.

- Market Volatility: DeFi loans are more exposed to fluctuations in cryptocurrency prices.

- Limited Support: No dedicated customer support teams, troubleshooting relies on community forums.

Uses of crypto loans

Crypto loans offer a variety of potential uses, some traditional and some unique to the crypto world. Here are some examples:

Traditional Uses:

- Leverage Trading: Investors can amplify their holdings in a cryptocurrency by borrowing and using it to buy more, potentially multiplying their gains if the price rises.

- Emergency Funds: Quickly access cash without selling crypto investments, particularly valuable during market downturns.

- Debt Consolidation: Refinance high-interest loans with a crypto loan potentially securing a lower rate.

- Major Expenses: Use a crypto loan for large purchases like a down payment on a house or car, avoiding the need to sell holdings.

Crypto-Specific Uses:

- Margin Trading: Use borrowed funds to buy and sell crypto assets on margin, increasing potential profits (and losses).

- DeFi Participation: Access collateral for participating in DeFi protocols like decentralized exchanges and lending platforms.

- Stablecoin Borrowing: Borrow stablecoins like USDC or USDT at potentially lower interest rates than traditional loans.

- Staking and Yield Farming: Use borrowed funds to increase your staked assets in DeFi protocols, potentially boosting your yield.

How to choose a crypto loan platform?

Choosing the right crypto loan platform is crucial for a safe and successful experience. Here are some key factors to consider:

1. Security and Trustworthiness:

- Platform Reputation: Research the platform’s history, track record, and user reviews. Look for established platforms with strong security measures and minimal security breaches.

- Regulatory Compliance: Choose platforms that comply with relevant financial regulations for added assurance.

- Insurance: Some platforms offer insurance for user funds, providing an extra layer of protection.

2. Loan Terms and Specifications:

- Supported Cryptocurrencies: Ensure the platform supports the cryptocurrencies you want to borrow or use as collateral.

- Loan-to-Value Ratio (LTV): Understand the maximum loan amount you can borrow relative to your collateral value.

- Interest Rates and Fees: Compare interest rates and fees across different platforms to find the most competitive offer.

- Repayment Terms: Choose a repayment schedule that fits your budget and financial situation.

3. User Interface and Experience:

- Ease of Use: Look for a platform with a user-friendly interface and intuitive navigation, especially if you’re new to crypto.

- Customer Support: Ensure the platform offers reliable and responsive customer support in case you need assistance.

- Mobile App: Consider platforms with mobile apps for convenient access and management of your loan on the go.

4. Additional Features:

- Margin Trading: Some platforms offer margin trading options if you’re interested in leveraging your loan.

- DeFi Integration: Platforms that integrate with DeFi protocols can provide access to additional opportunities.

- Educational Resources: Look for platforms that offer educational resources to help you understand crypto loans and make informed decisions.

5. Community and Reviews:

- Community Forums: Engage with the platform’s community to gain insights and learn from other users’ experiences.

- Independent Reviews: Read independent reviews and comparisons of different crypto loan platforms.

Benefits and Risks of crypto loans

Crypto loans offer both potential benefits and significant risks, and it’s crucial to understand both sides before entering the world of crypto borrowing. Here’s a breakdown:

Benefits:

- Access liquidity without selling: You can access cash without selling your crypto holdings, potentially benefiting from long-term price appreciation.

- Amplify returns: Leverage trading with borrowed funds can magnify your profits if the market moves in your favor.

- Diversification opportunities: Access DeFi protocols and participate in yield farming or other strategies by using borrowed funds.

- Emergency funds: Secure quick cash for unexpected expenses without liquidating crypto during a downturn.

- Potentially lower interest rates: Compared to traditional loans, some crypto loans offer competitive interest rates, especially for stablecoins.

Risks:

- Volatility: Crypto markets are notoriously volatile, and price fluctuations can significantly impact your collateral value and loan terms.

- Margin calls: If your collateral value falls below a certain threshold, you may face a margin call, forcing you to deposit additional collateral or face liquidation.

- Smart contract risks: With DeFi loans, smart contract vulnerabilities can lead to hacks or unexpected outcomes.

- Platform risk: Centralized platforms are susceptible to hacks, mismanagement, or regulatory changes that could impact your funds.

- Debt burden: Overborrowing can lead to a heavy debt burden, especially if the market turns against you.

- Limited regulatory oversight: The crypto space is less regulated than traditional finance, increasing the risk of scams or unethical practices.

In Conclusion, Crypto loans represent a dynamic and transformative facet of the cryptocurrency ecosystem, providing users with alternative financial avenues. By understanding the intricacies of crypto loans, individuals can make informed decisions, navigate the evolving landscape, and harness the potential benefits offered by this innovative financial tool.