Cryptocurrency has revolutionized the financial world, providing a decentralized and secure way to transact. At the core of this landscape are exchanges that facilitate the buying, selling, and trading of digital assets. Among them, Centralized Exchanges (CEX) stand as prominent platforms, offering distinct features, benefits, and risks within the crypto sphere.

What is CEX?

A centralized exchange (CEX) is a type of cryptocurrency exchange that operates through a centralized platform, meaning that all transactions are settled off-chain and its operations are controlled and managed by a single entity.

CEXs are similar to traditional stock exchanges, in that they use an order book to match buyers and sellers. However, unlike decentralized exchanges (DEXs), CEXs hold custody of users’ funds and assets. This means that users must trust the CEX to keep their funds safe and to execute their trades fairly.

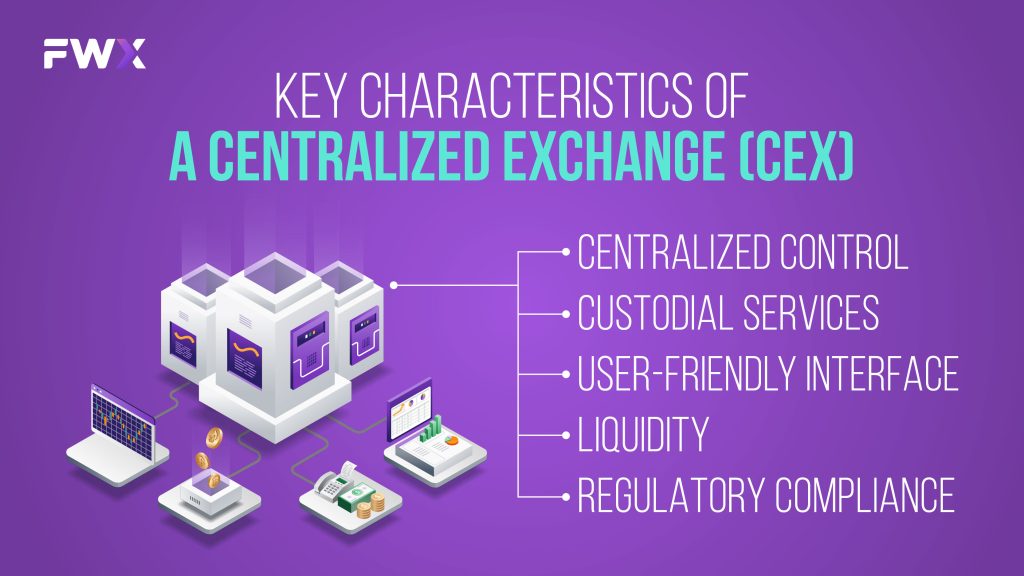

Key characteristics of a Centralized Exchange (CEX)

The key characteristics of a Centralized Exchange (CEX) are as follows:

- Centralized control: CEXs are managed and operated by a central authority. This means that the exchange has control over all aspects of its operations, including security, customer support, and trading operations.

- Custodial services: Most CEXs offer custodial services, which means that they hold users’ funds on their platform. This gives users the convenience of not having to manage their own private keys, but it also means that they must trust the CEX to keep their funds safe.

- User-friendly interface: CEXs typically have user-friendly interfaces that make it easy for users to buy, sell, and trade cryptocurrencies.

- Liquidity: CEXs typically have high liquidity, meaning that there are always buyers and sellers for the cryptocurrencies that they support. This makes it easy for users to execute trades quickly and efficiently.

- Regulatory compliance: CEXs are increasingly being regulated by governments around the world. This means that they must comply with a variety of regulations, such as KYC/AML (Know Your Customer/Anti-Money Laundering) and anti-fraud regulations.

How Does CEX Work?

Centralized exchanges (CEXs) work by acting as intermediaries between buyers and sellers of cryptocurrency. They do this by maintaining an order book, which is a list of all the buy and sell orders for a particular cryptocurrency, sorted by price.

When a user places an order to buy or sell cryptocurrency on a CEX, their order is added to the order book. Once a buyer’s order matches a seller’s order, a trade is executed. The CEX then facilitates the trade by transferring the cryptocurrency from the seller’s wallet to the buyer’s wallet.

Step-by-step overview of how a CEX works:

- Users create an account and deposit their funds. CEXs typically require users to complete KYC/AML (Know Your Customer/Anti-Money Laundering) checks before they can deposit or withdraw funds.

- Users place orders to buy or sell cryptocurrencies. When a user places an order, it is added to the order book. The order book is a list of all the buy and sell orders for a particular cryptocurrency, sorted by price.

- When a buy order matches a sell order, a trade is executed. CEXs typically charge a fee for each trade that is executed on their platform.

Types of Centralized Exchanges

There are many different types of centralized exchanges (CEXs), each with its own unique features and offerings. Some of the most common types of CEXs include:

- Spot exchanges: Spot exchanges allow users to buy and sell cryptocurrencies at the current market price.

- Margin exchanges: Margin exchanges allow users to trade cryptocurrencies on margin, which means that they can borrow money from the exchange to trade with.

- Futures exchanges: Futures exchanges allow users to trade futures contracts on cryptocurrencies. A futures contract is an agreement to buy or sell a cryptocurrency at a specified price on a future date.

- Derivatives exchanges: Derivatives exchanges allow users to trade derivatives contracts on cryptocurrencies. Derivatives contracts are financial instruments that derive their value from the underlying asset, which in this case is cryptocurrency.

- Fiat on-ramp/off-ramp exchanges: Fiat on-ramp/off-ramp exchanges allow users to deposit and withdraw fiat currencies, such as USD, EUR, and GBP. This makes them a convenient way for new users to enter the cryptocurrency market.

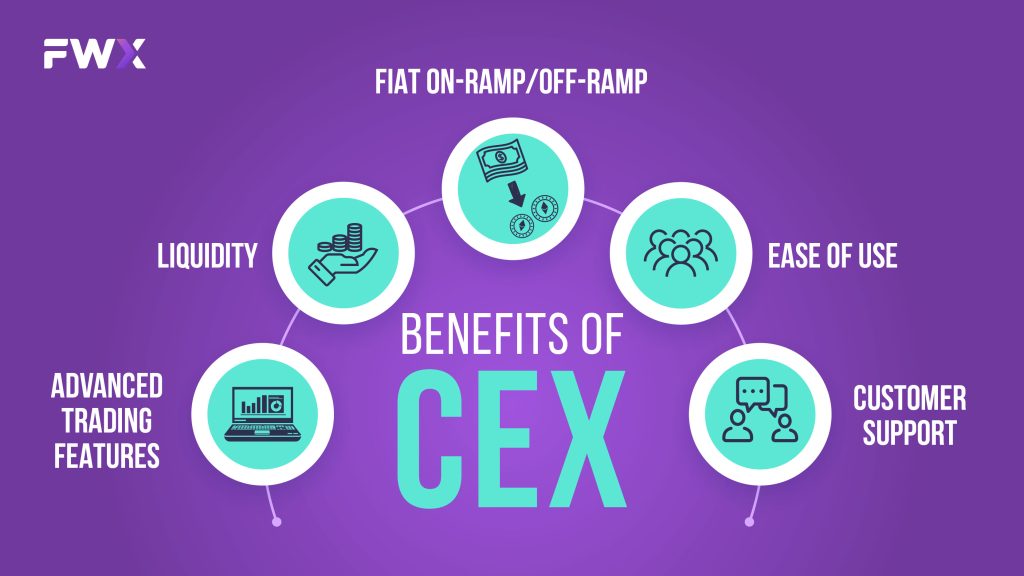

Benefits of CEX

- Ease of use: CEXs are typically very user-friendly and easy to use, even for beginners.

- Liquidity: CEXs typically have high liquidity, meaning that there are always buyers and sellers for the cryptocurrencies that they support.

- Fiat on-ramp/off-ramp: CEXs typically allow users to deposit and withdraw fiat currencies, such as USD, EUR, and GBP. This makes them a convenient way for new users to enter the cryptocurrency market.

- Customer support: CEXs typically offer customer support to help users with any problems that they may have.

- Advanced trading features: CEXs often offer advanced trading features, such as margin trading and futures trading.

Risks of CEX

CEXs also come with a number of risks, including:

- Centralization: The fact that CEXs are centralized means that they are a single point of failure. If a CEX is hacked or goes bankrupt, users could lose their funds.

- Counterparty risk: CEXs hold custody of users’ funds and assets. This means that users must trust the CEX to keep their funds safe and to execute their trades fairly.

- Regulation: CEXs are increasingly being regulated by governments around the world. This could lead to increased compliance costs for CEXs and could even make it difficult for users in certain jurisdictions to use CEXs.

- Pricing manipulation: CEXs are vulnerable to pricing manipulation, as large traders can potentially influence the price of cryptocurrencies on the exchange.

- Security breaches: CEXs have been the target of numerous security breaches in the past. This means that there is always a risk that users’ funds could be stolen from a CEX.

Conclusion

Centralized Exchanges play a significant role in the cryptocurrency landscape, offering convenience and accessibility. However, their centralized structure poses inherent risks. Striking a balance between convenience and security becomes crucial. As the crypto industry evolves, comprehending the dynamics of CEX empowers individuals to make informed decisions when navigating the expansive world of cryptocurrency exchanges.