The world of decentralized finance (DeFi) is constantly evolving, introducing innovative tools and mechanisms that push the boundaries of traditional finance. One such innovation is the flash loan, a unique type of loan that allows users to borrow large sums of crypto assets without collateral, on one condition: they must be repaid within the same block transaction.

This article delves deep into the fascinating world of flash loans, exploring their mechanics, benefits, risks, and potential for both good and bad.

What is a Flash Loan?

A flash loan is a type of decentralized finance (DeFi) transaction that allows users to borrow a significant amount of cryptocurrency for a very short period, typically within a single transaction block on a blockchain. What makes flash loans unique is that they are uncollateralized, meaning borrowers don’t need to provide any collateral to secure the loan.

The entire loan process, including borrowing and repaying, occurs within a single transaction block on a blockchain like Ethereum. Flash loans are made possible by the composability and programmability of smart contracts. Users can borrow funds, perform various operations or transactions with those funds, and then repay the loan in the same transaction block. If the borrower fails to repay the loan within the same block, the entire transaction is reversed, and the loan is considered void.

Flash loans are powerful financial tools that can be used for various purposes, such as arbitrage trading, collateral swapping, and liquidity provision. However, they also come with risks and have been associated with some vulnerabilities and exploits in the DeFi space. Developers and users need to be cautious and implement robust security measures when working with flash loans to mitigate potential risks.

How Do Flash Loans Work?

Flash loans, with their lightning speed and no-collateral requirement, might seem like magic, but their inner workings are actually quite fascinating and rely on the power of smart contracts and blockchain technology. Let’s break down the steps involved:

1. Initiating the Loan:

You, the borrower, create a smart contract. This code-based agreement outlines the key details:

- Amount: How much you want to borrow.

- Target Protocol: From which DeFi lending pool you want the funds.

- Flash Loan Actions: A series of pre-programmed instructions outlining what you will do with the borrowed funds (e.g., arbitrage, collateral swap).

2. Instantaneous Transfer:

Once you initiate the smart contract, the magic happens. The lending pool instantly transfers the requested amount to your address. No waiting for approvals, no need for collateral, just instant access to a potentially large sum of crypto.

3. Executing Your Strategy:

This is where the fun begins! Your pre-programmed smart contract takes over, automatically executing the planned actions using the borrowed funds. For example:

- Arbitrage: If you want to exploit price discrepancies, your contract could buy asset A on one exchange, sell it on another for a profit, and then use the proceeds to repay the loan.

- Collateral Swap: Your contract could swap your existing collateral for another type with better borrowing rates, freeing up capital or unlocking access to new opportunities.

4. Repayment within the Block:

Remember, flash loans are all about speed and precision. Everything needs to happen within the same block transaction, usually just a few seconds. So, before the block is confirmed and finalized, your smart contract automatically pays back the borrowed amount plus a small fee to the lending pool.

5. Block Confirmation and Loan Completion:

If all steps were executed flawlessly within the block timeframe, the block is confirmed, and the transaction is finalized. The borrowed funds disappear from your address, and you’ve successfully leveraged a flash loan to achieve your desired outcome.

Key Features of Flash Loans

Flash loans have carved a unique niche in the DeFi space thanks to several key features that set them apart from traditional loans:

- Uncollateralized: Unlike traditional loans where you pledge assets as security, flash loans require no collateral. This opens doors for users who might not have the necessary capital to secure traditional loans, allowing them to leverage large sums for various strategies.

- Instantaneous: Time is of the essence in DeFi, and flash loans deliver. The borrowing and repayment process happens within the same block transaction, typically just seconds. This speed is crucial for capitalizing on fleeting opportunities like arbitrage or exploiting price discrepancies.

- Atomic: This is the magic behind the safety net. Flash loans are all or nothing. The borrowed funds must be repaid within the same block transaction. If anything goes wrong, or your smart contract fails to execute the desired actions, the entire transaction is reversed, leaving both the lender and borrower unscathed.

- Fee-based: While no collateral is required, flash loans aren’t entirely free. Lenders charge a small fee, typically a percentage of the borrowed amount, for facilitating the loan. This fee incentivizes lenders to participate and helps maintain the liquidity of the lending pool.

- Permissionless: In true DeFi spirit, flash loans are open to anyone. There are no credit checks, no identity verification, just a smart contract and a willing lending pool. This accessibility democratizes access to capital and empowers individuals to participate in DeFi regardless of their background or financial standing.

Flash Loan Use Cases

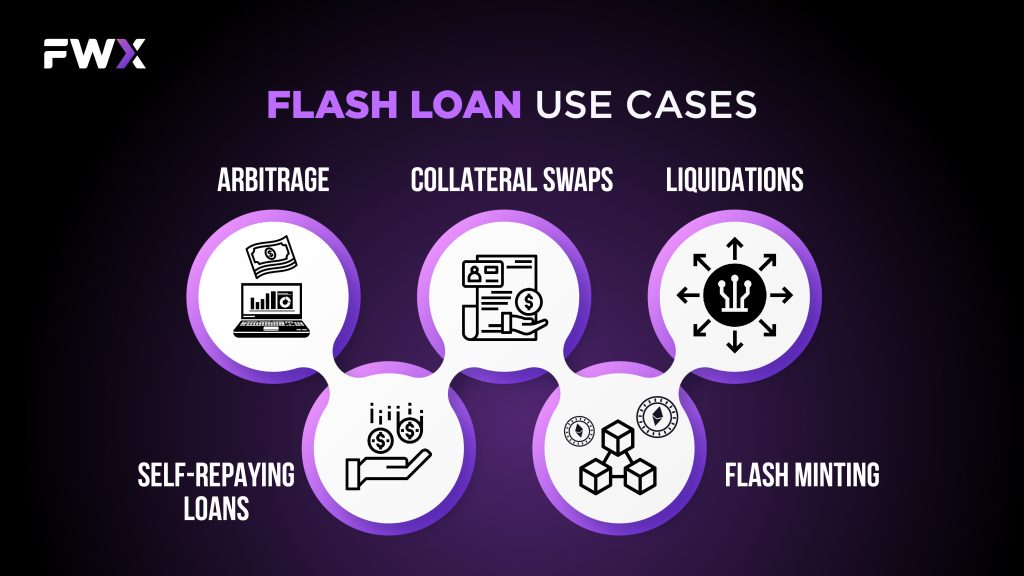

Flash loans, with their unique blend of speed, flexibility, and lack of collateral requirements, have opened up a world of possibilities in the DeFi space. Let’s explore some of the most common flash loan use cases:

- Arbitrage: This is a classic use case where traders leverage flash loans to exploit price discrepancies across different DeFi exchanges. They borrow funds, buy the asset cheaper on one platform, instantly sell it for a profit on another, and repay the loan with interest, all within the same block. This capitalizes on fleeting market inefficiencies and can generate quick profits for skilled traders.

- Collateral Swaps: Imagine you have an asset locked as collateral for a loan on one platform, but you find better borrowing rates elsewhere. A flash loan can help! You borrow funds, use them to repay your existing loan, freeing up your collateral, and then immediately use the borrowed funds to open a new loan on the platform with better rates. This optimizes your borrowing costs and unlocks trapped capital.

- Liquidations: Sometimes, borrowers on other DeFi platforms might have their positions undercollateralized, meaning their collateral value falls below the loan amount. Flash loans can be used to facilitate these liquidations. You borrow funds, use them to buy the undercollateralized asset, instantly sell it to repay the loan and earn a liquidation bonus, and potentially pocket the remaining difference. This helps maintain stability in the DeFi ecosystem by preventing bad debt.

- Self-Repaying Loans: Flash loans aren’t just for arbitrageurs and liquidators. You can even use them to “borrow for free” by employing them in strategies that generate returns exceeding the loan interest. For example, you could borrow funds, use them to participate in yield farming protocols, earn interest, and then repay the loan with the earned interest, leaving you with a profit.

- Flash Minting: Launching a new token can be challenging, especially attracting initial liquidity. Flash loans can come to the rescue! You borrow funds, use them to create your new token and simultaneously provide liquidity for it on an exchange, essentially creating a market for your token out of thin air. This jumpstarts trading activity and attracts potential investors.

Flash Loan Benefits and Risks

Flash loans, with their unorthodox approach to borrowing, offer a unique set of advantages that have shaken up the DeFi landscape. Let’s dive into the key benefits that make flash loans so appealing:

- Increased Capital Efficiency: Flash loans remove the barrier of collateral, allowing anyone with a DeFi wallet to access potentially large sums of capital. This empowers individuals and smaller players to compete with well-funded institutions, fostering a more inclusive and democratized financial system.

- Reduced Transaction Costs: Compared to traditional loans, flash loans eliminate the need for intermediaries like underwriters and loan agents. This translates to lower fees and charges, making borrowing more cost-effective for users.

- Accessibility to Advanced Features: Flash loans can be combined with other DeFi instruments like derivatives and margin trading to unlock advanced financial strategies that were previously only accessible to sophisticated investors. This empowers individuals to explore new avenues for wealth creation and experiment with innovative financial tools.

- Automation and Precision: The programmable nature of flash loans allows for complete automation of borrowing and repayment processes. By pre-programming your smart contract, you can eliminate human error and ensure the execution of your strategy with precision, maximizing efficiency and minimizing risks.

- Transparency and Auditability: Every step of a flash loan transaction is recorded on the blockchain, providing unparalleled transparency and auditability. This fosters trust and accountability within the DeFi ecosystem, attracting users who value security and immutability.

- Permissionless Access: Unlike traditional financial institutions, anyone with a DeFi wallet can access flash loans, regardless of their credit score or financial background. This removes barriers to entry and promotes financial inclusion, empowering individuals to take control of their finances in new ways.

While flash loans offer a plethora of benefits in the DeFi space, it’s crucial to acknowledge the inherent risks that come with their speed, flexibility, and lack of collateral requirements. Let’s delve into some key risks to be mindful of:

- Smart Contract Exploits: The magic of automation also carries the risk of bugs or vulnerabilities in your smart contract code. These can be exploited by malicious actors to steal borrowed funds or manipulate the loan execution process for their gain. Therefore, secure coding practices, rigorous audits, and a deep understanding of smart contract security are paramount before venturing into flash loans.

- Flash Loan Attacks: These are coordinated exploits where attackers leverage the power of flash loans to manipulate markets, drain liquidity from pools, or gain an unfair advantage. These attacks often involve complex combinations of arbitrage, price manipulation, and reentrancy vulnerabilities in smart contracts. Staying informed about common attack vectors, employing robust security measures, and thoroughly stress-testing your smart contract are essential to mitigating these risks.

- Impermanent Loss: Flash loan-based strategies like arbitrage can be lucrative, but they are also susceptible to rapid price fluctuations. If not managed carefully, you could end up with less value than you started with, experiencing what is known as “impermanent loss.” Understanding market dynamics, setting stop-loss orders, and diversifying your strategies can help you navigate this volatile landscape.

- Liquidation Risk: Remember, the clock is ticking with flash loans. You must repay the borrowed amount plus interest within the same block transaction. If you fail to do so, your collateral will be automatically liquidated to cover the debt. To avoid this scenario, carefully calculate your borrowing needs, manage your positions actively, and maintain sufficient collateral to weather unexpected market movements.

- Regulatory Uncertainty: The DeFi space, including flash loans, is still evolving, and regulatory landscapes are yet to fully catch up. This can create uncertainty and potential legal challenges down the road. Staying informed about regulatory developments, adhering to compliance requirements, and seeking professional guidance can help mitigate these risks.

What is a Flash Loan Attack?

A flash loan attack is a sophisticated exploit in decentralized finance (DeFi) where an attacker borrows a significant amount of cryptocurrency without collateral using a flash loan. Within a single transaction block, the attacker executes a series of transactions, exploiting vulnerabilities, manipulating markets, or conducting malicious activities to generate profits.

The success of the attack relies on repaying the loan within the same block; failure results in the entire transaction being reverted. Flash loan attacks underscore the importance of robust smart contract security and vigilance within the rapidly evolving landscape of decentralized finance. Preventive measures include code audits, transaction limits, and enhanced monitoring.

How does Flash loan Attack work?

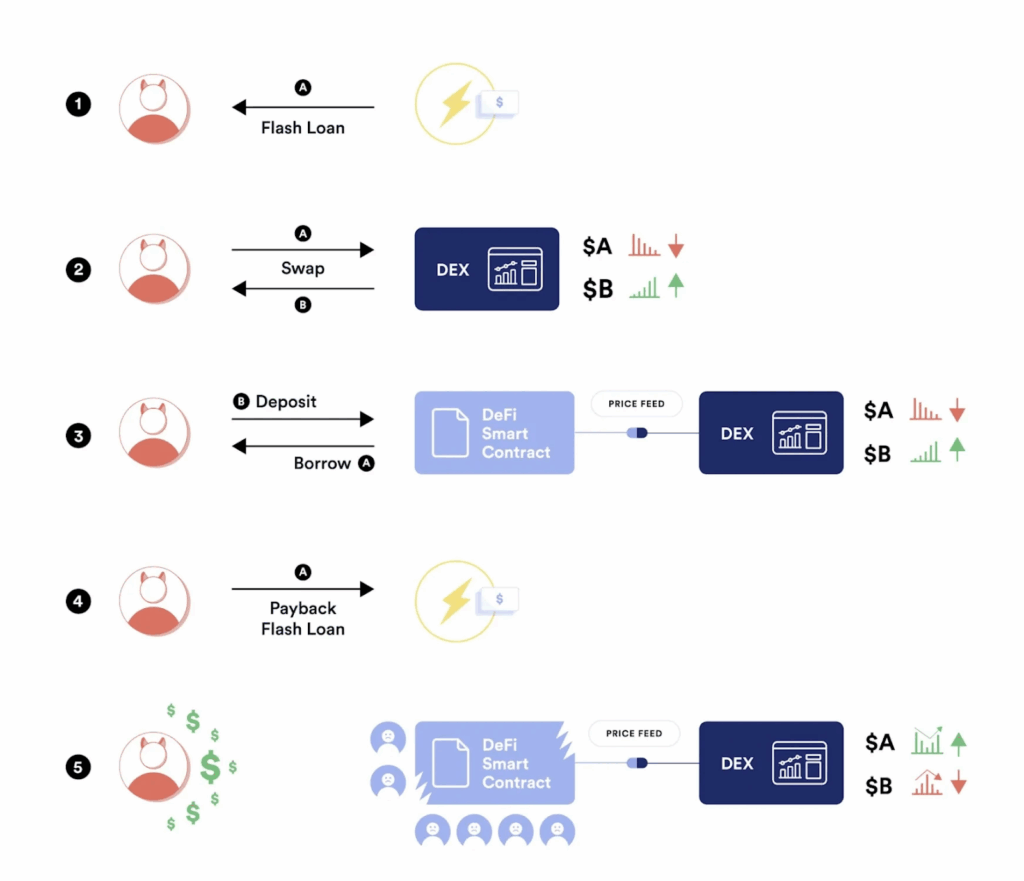

- Borrowing Funds: The attacker initiates a flash loan, borrowing a large amount of cryptocurrency without collateral. Flash loans allow for uncollateralized borrowing within a single transaction block.

- Execution of Transactions: With the borrowed funds, the attacker executes a series of transactions. These transactions are carefully crafted to exploit vulnerabilities, manipulate token prices, or perform other actions for financial gain.

- Market Manipulation or Exploitation: The attacker’s transactions may involve actions like manipulating decentralized exchange prices, exploiting arbitrage opportunities, triggering specific conditions in smart contracts, or exploiting weaknesses in DeFi protocols.

- Profit Generation: The primary goal is to generate profits for the attacker through various means, such as making profitable trades, draining funds from vulnerable protocols, or capitalizing on market inefficiencies.

- Repayment of Flash Loan: To succeed, the attacker must repay the entire borrowed amount, including fees and interest, within the same transaction block. If repayment doesn’t occur within the timeframe, the entire transaction is reverted.

- Reversion of Transactions: If the attacker fails to repay, the entire block’s transactions, including those made during the attack, are automatically reverted. This mechanism protects lenders and maintains the integrity of the DeFi ecosystem.

How to Prevent Flash Loan Attacks

- Code Audits and Security Reviews: Conduct thorough code audits and security reviews of smart contracts involved in flash loans. Identify and rectify vulnerabilities before deploying or interacting with these contracts.

- Limit Loan Amounts: Implement limits on the amount that can be borrowed in a single flash loan transaction. This helps reduce the potential impact of attacks and limits the scope of malicious activities.

- Circuit Breakers: Integrate circuit breakers or emergency shutdown mechanisms in smart contracts to halt operations in response to unexpected events or suspicious activities. This can provide a quick response to potential threats.

- Enhanced Monitoring: Employ advanced monitoring tools to detect abnormal transaction patterns, large price movements, or other signs indicative of potential attacks. Real-time monitoring can enable a swift response to suspicious activities.

- Oracle Safeguards: Implement robust price oracles with safeguards to prevent manipulation and ensure accurate asset valuations during flash loan transactions. Secure and reliable oracles are critical to preventing price manipulation.

- Community Collaboration: Foster collaboration within the DeFi community to share information about potential vulnerabilities, exploits, and best practices for security. A collective effort can help identify and address emerging threats.

- Insurance and Risk Mitigation: Utilize decentralized insurance protocols or other risk mitigation strategies to provide protection against potential losses in the event of a flash loan attack. Insurance can help mitigate financial risks associated with security incidents.

- Regulatory Compliance: Stay informed about regulatory developments and compliance requirements to ensure that DeFi projects and platforms operate within legal and regulatory frameworks. Compliance measures can contribute to a more secure and sustainable ecosystem.

- Smart Contract Upgrades: Regularly update and upgrade smart contracts to address any discovered vulnerabilities or implement improvements in security. Continuous development and maintenance are crucial for staying ahead of potential threats.

- Transaction Sequencing: Implement transaction sequencing mechanisms to ensure that critical operations occur in the desired order. Proper sequencing can prevent attackers from taking advantage of reentrancy or front-running vulnerabilities.

Flash loans have revolutionized DeFi, offering unparalleled opportunities for users while introducing new challenges. Understanding the mechanics, risks, and preventive measures associated with flash loans is crucial for navigating this dynamic landscape responsibly. By implementing robust security practices, engaging in community collaboration, and staying informed about emerging threats, participants can contribute to a more secure and resilient DeFi ecosystem.