Those who are interested in learning about the latest trends in the financial industry and how technology is changing the way we think about and interact with money may want to read this article about how DeFi (Decentralized Finance) is revolutionizing finance.

What is DeFi?

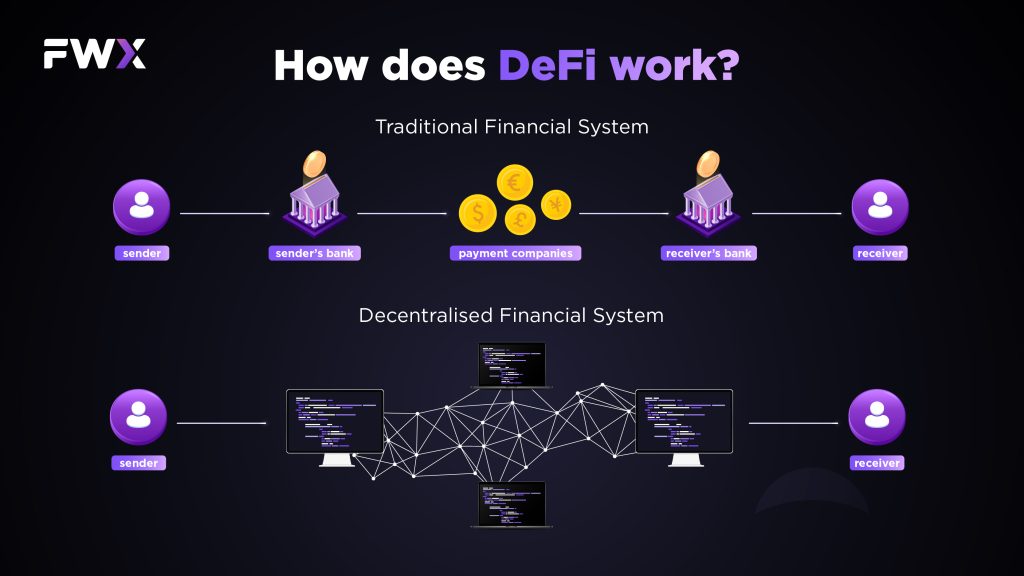

DeFi (Decentralized Finance) is a term used to describe a new financial system built on blockchain technology that allows people to access financial services without intermediaries such as banks or financial institutions. It uses smart contracts to automate the management of financial transactions, such as lending, borrowing, trading, and investing. It provides users with greater control over their funds, as well as increased transparency and security. DeFi are built on decentralized networks such as Ethereum and are open to anyone with an internet connection. The decentralized nature of DeFi allows for greater inclusivity and accessibility to financial services.

How does DeFi work?

Decentralized Finance, is a financial system that operates on the blockchain network using smart contracts. These smart contracts are computer programs that execute transactions automatically without the need for intermediaries like banks or other financial institutions.

Users of the DeFi protocol can interact with these smart contracts using their wallets to transfer funds, borrow, lend, or access any other service provided by the DeFi.

One of the major advantages of DeFi is that it provides easy and cheaper access to capital, efficient lending and borrowing, and decentralized crypto and synthetic stock exchanges. Because of its decentralized nature, some projects like Uniswap have become highly efficient global financial markets catering to individuals and institutions alike. In addition, DeFi removes middlemen and enables more efficient financial services at low costs.

Another important feature of It is that it operates on a blockchain network, which means that all the transactions are publicly visible and immutable. Once a transaction is recorded on the blockchain network, it cannot be changed. This creates a trustless financial system that relies on code, and one such example is a Decentralized Exchange (DEX).

The rising popularity of DEX

Decentralized Finance has brought a sweeping change to the financial world in recent years. With disintermediation as its core philosophy, transactions on DeFi and Decentralized Exchanges (DEXs) on the blockchain network have gained huge popularity.

Unlike centralized financial services, DeFi do not require intermediaries or custodians to provide services such as buying, selling, lending, and borrowing of crypto assets. Users can interact directly with the blockchain protocol to execute trades or avail services. Decentralized Exchanges, in particular, use a technology called “Automated Market Makers” (AMM) to provide asset-specific liquidity pools, enabling deep liquidity and offering serious passive income through trading fees.

DEX users can provide liquidity of those assets in these liquidity pools, retain their cryptocurrency ownership, and have complete control over their assets in their wallets. DeFi and DEXs rely on self-regulating computer code called “smart contracts” that run on a blockchain network, creating a non-custodial framework for users.

Most DeFi projects are built on the Ethereum blockchain network, which has the first-movers advantage in providing infrastructure that enables developers to build decentralized applications (DApps).

Despite being fairly complex with a steep learning curve, DEXs and DeFi projects are slowly becoming a lucrative option for SMEs and startups in the FinTech space around the world. With low barriers to entry as compared to traditional finance, DeFi and DEXs provide easier access to cheaper credit, easy lending and borrowing activities, changing the landscape of traditional financial systems.

Enhancement of the insurance business

DeFi has revolutionized several industries, including insurance, savings and investments, and borrowing and lending protocols. The insurance industry has seen significant improvements in efficiency through the use of smart contracts, which offer a faster and more streamlined process. DeFi projects like Nexus Mutual, Opyn, and VouchForMe are providing insurance coverage for cryptocurrency on the blockchain network.

DeFi has also provided alternative solutions for savings and investments. Projects like PoolTogether, Dharma, and Argent have created risk-free savings strategies using no-loss savings protocols. This has become especially important as traditional savings and investments have become difficult for middle-class people due to increasing inflation rates and decreasing interest rates in fiat currencies.

In terms of borrowing and lending, DeFi has enabled peer-to-peer (P2P) borrowing and lending through platforms like Compound and PoolTogether. Distributed ledger technology has made transactions faster and more efficient, particularly for cross-border payments where traditional banking systems have caused delays and transaction costs.

DeFi has also facilitated tokenization, allowing for the creation and management of digital assets on a blockchain network. Tokenization has led to the growth of a new form of economy, with digital assets being tokenized as NFTs to store, create, or trade value. Additionally, DeFi-based prediction platforms have emerged, allowing users to trade value by forecasting the outcome of future events.

DeFi has replaced traditional banking systems and provided a more accessible, efficient, and democratic financial ecosystem. As more blockchain networks like Solana, Cardano, and Polkadot enter the DeFi space, the industry is set to become even more competitive and innovative.

Reinventing the gaming industry

DeFi has expanded beyond the financial industry and is now being used in other areas, such as gaming and eSports. DeFi technology has enabled game developers to use tokens for in-app purchases and loot box features, which has created a new genre of collectible and trading games on blockchain. Users can also place bets on world events using DeFi platforms like Augur. While DeFi has experienced significant growth, its decentralized nature introduces certain risks, such as the lack of regulation or insurance on investments.

Decentralized exchanges offer many benefits, such as increased privacy and independence, but they also come with certain risks. DeFi loans are collateralized with other crypto assets, making them vulnerable to downturns in the market. Additionally, there is a potential for lost data and account information, which cannot be retrieved on DEXs. As more people enter the digital asset space, DeFi will need to become more robust in terms of security and scalability.

While centralized systems still dominate market activity due to their user-friendly interfaces, security, regulatory oversight, and insurance facilities, the growth of DeFi has created space for decentralized crypto exchange protocols. The upgrade of the Ethereum network to Ethereum 2.0 is already beginning to expand DeFi’s capabilities. In the near future, DEX is sure to make cryptocurrency trading more fair, private, and independent, thereby accelerating the growth of decentralized finance and its supporting mechanisms. The latest developments and trends in crypto investments definitely look promising for Decentralized Exchanges.

Conclusion

In conclusion, the growth of DeFi has expanded beyond the financial industry and has found applications in other areas such as gaming and eSports. This has increased its adoption and potential for growth, but it also introduces certain risks, such as the lack of regulation and insurance on investments done on DeFi. However, the potential benefits of decentralized exchanges are significant, and as more people enter the digital asset space, DeFi will need to become more robust in terms of security and scalability. Overall, the latest developments and trends in crypto investments look promising for decentralized exchanges, and it is likely that they will continue to make cryptocurrency trading more fair, private, and independent in the future.